☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted byRule 14a-6(e)(2)) | |||

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 | |||

☒ | No fee required. | |||

☐ | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| Fee paid previously with preliminary | |||

| ☐ | ||||

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act 14a-6(i)(1) and | |||

| ||||

| ||||

| ||||

| ||||

0-11. | ||||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 11, 2017JUNE 7, 2024

To the Stockholders of Apollo Commercial Real Estate Finance, Inc.:

The 20172024 annual meeting of stockholders (the “Annual Meeting”) of Apollo Commercial Real Estate Finance, Inc., a Maryland corporation (“ARI,” theour “Company,” “we,” “our” or “us”), will be held at the offices of Clifford Chance US LLP, 31 West 52nd Street, New York, New York 10019, on May 11, 2017,June 7, 2024, at 9:00 a.m., Eastern Time, to consider and vote on the following matters:

| (1) | The election of |

| (2) | The ratification of the appointment of Deloitte & Touche LLP as ARI’s independent registered public accounting firm for the |

| (3) | A resolution to approve, on an advisory basis, the compensation of ARI’s named executive officers, as more fully described in the accompanying proxy statement; |

| (4) | The |

| (5) | The transaction of such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof. |

The close of business on MarchApril 15, 20172024 has been fixed by our board of directors as the record date (the “Record Date”) for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting orand any postponements or adjournments thereof.

We hope that allAll stockholders who can do so willare cordially invited to attend the Annual Meeting in person.virtually. By hosting the Annual Meeting via a live webcast, we believe we are able to communicate more effectively with our stockholders and enable increased attendance and participation from locations around the world. Whether or not you plan to attend the virtual Annual Meeting, in order to assure proper representation of your shares at the Annual Meeting, we urge you to submit your proxy voting instructions to ARI.instructions. By submitting your proxy voting instructions promptly, you can help ARI avoid the expense offollow-up follow up mailings and ensure the presence of a quorum at the Annual Meeting. If you are a stockholder of record or you hold a proxy from a stockholder of record and attend the Annual Meeting, you may, if so desired, revoke your prior proxy voting instructions and vote your shares electronically at the Annual Meeting.

In order to attend and participate in person.the virtual Annual Meeting, you must register in advance at www.viewproxy.com/apollocref/2024/htype.asp by 11:59 p.m., Eastern Time, on June 4, 2024. Upon registering, you will receive a meeting invitation by email with your unique join link along with a password prior to the meeting date. Stockholders have substantially the same opportunities to participate in our virtual Annual Meeting as they would have in an in-person meeting and will be able to listen, vote and submit questions during the virtual meeting.

The Annual Meeting will begin promptly at 9:00 a.m., Eastern Time. Please check in by 8:45 a.m., Eastern Time, on the day of the Annual Meeting so that any technical difficulties may be addressed before the live webcast begins.

If you holdare a registered holder of shares of our common stock, par value $0.01 per share (“Common Stock”), as of the close of business on the Record Date, you may vote your shares of Common Stock by proxy or electronically at the Annual Meeting, and your Virtual Control Number will be on your Notice of Internet Availability of Proxy Materials or proxy card. If you hold shares of our Common Stock in “street name” through a broker or other financial institution, you must follow the instructions provided by your broker or other financial institution regarding how to instruct your broker or financial institution to vote your shares of Common Stock. If you hold your shares in “street name” through a broker or other financial institution and you wish to vote electronically at the Annual Meeting, you must provide a legal proxy from your broker or other financial institution during registration and you will be assigned a Virtual Control

Number in order to vote electronically during the Annual Meeting. If you do not obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares electronically at the meeting) so long as you demonstrate proof of stock ownership when you register to attend the Annual Meeting. Instructions on how to register, connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://viewproxy.com/apollocref/2024/htype.asp.

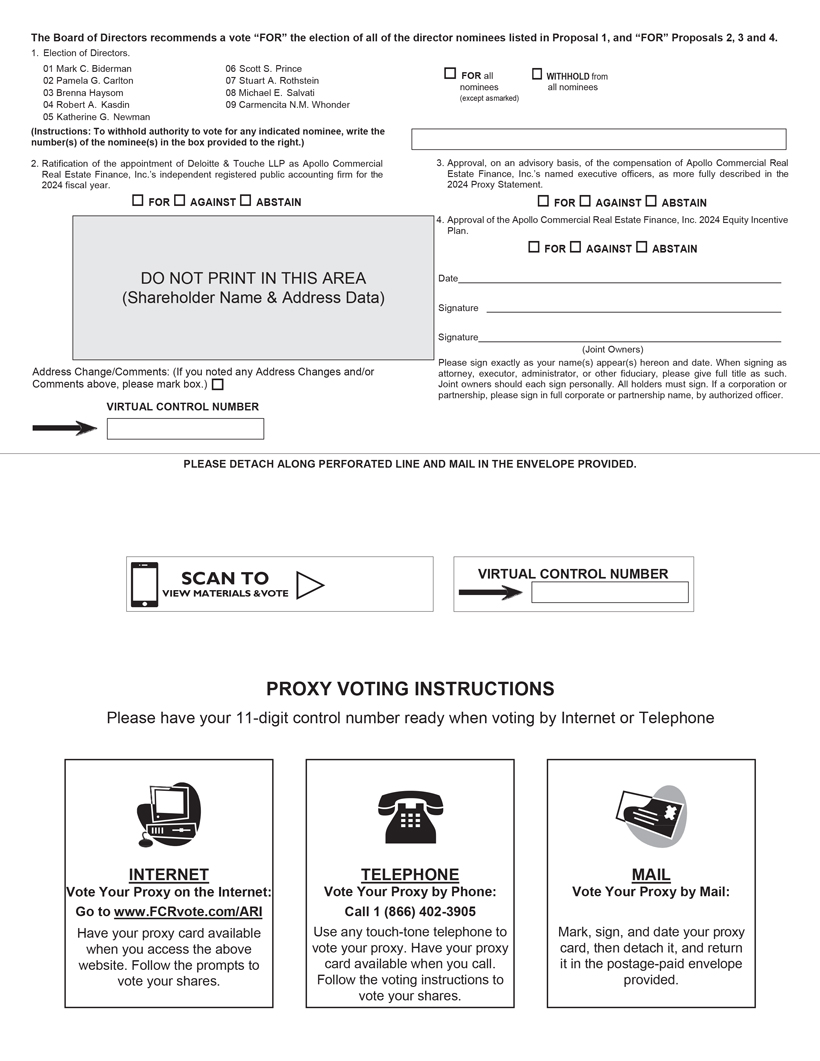

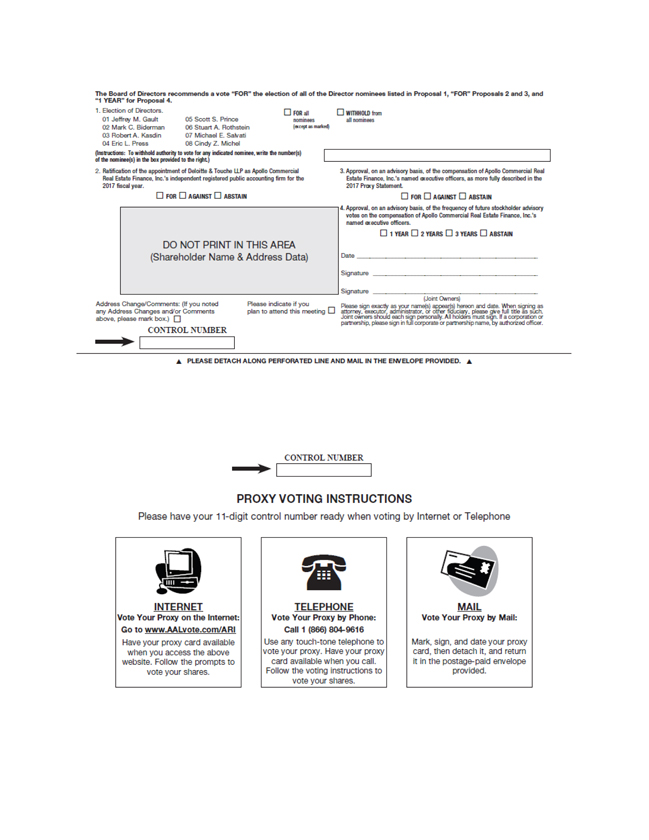

Your proxy is being solicited by our board of directors. Our board of directors recommends that you vote FOR the election of the nominees listed in the accompanying proxy statement to serve on our board of directors until our 20182025 annual meeting of stockholders and until their respective successors are duly elected and qualify, FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 20172024 fiscal year, FOR the resolution to approve, on an advisory basis, the compensation of our named executive officers and FOR on an advisory basis, a frequencythe approval of “1 YEAR” for future advisory votes on the compensation of our named executive officers.Apollo Commercial Real Estate Finance, Inc. 2024 Equity Incentive Plan.

| By Order of the Board, |

| /s/ |

Chief Financial Officer, Treasurer and Secretary |

New York, New York

March 31, 2017April 26, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held May 11, 2017.June 7, 2024. The Proxy Statement and our 20162023 Annual Report to Stockholders are available at:

http://viewproxy.com/apolloreit/2017/.www.viewproxy.com/apollocref/2024.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 11, 2017JUNE 7, 2024

This Proxy Statement is being furnished to stockholders in connection with the solicitation of proxies by and on behalf of the board of directors of Apollo Commercial Real Estate Finance, Inc., a Maryland corporation (“ARI,” theour “Company,” “we,” “our” or “us”), for use at ARI’s 20172024 annual meeting of stockholders (the “Annual Meeting”) to be held at the offices of Clifford Chance US LLP, 31 West 52nd Street, New York, New York 10019, on May 11, 2017,June 7, 2024, at 9:00 a.m., Eastern Time, or at any postponements or adjournments thereof.

All stockholders are cordially invited to attend the Annual Meeting virtually. By hosting the Annual Meeting via a live webcast, we believe we are able to communicate more effectively with our stockholders and enable increased attendance and participation from locations around the world. Whether or not you plan to attend the virtual Annual Meeting, in order to assure proper representation of your shares at the Annual Meeting, we urge you to submit your proxy voting instructions. By submitting your proxy voting instructions promptly, you can help ARI avoid the expense of follow up mailings and ensure the presence of a quorum at the Annual Meeting. If you are a stockholder of record or you hold a proxy from a stockholder of record and attend the Annual Meeting, you may, if so desired, revoke your prior proxy voting instructions and vote your shares electronically at the Annual Meeting.

In order to attend and participate in the virtual Annual Meeting, you must register in advance at www.viewproxy.com/apollocref/2024/htype.asp by 11:59 p.m., Eastern Time, on June 4, 2024. Upon registering, you will receive a meeting invitation by email with your unique join link along with a password prior to the meeting date. Stockholders will have substantially the same opportunities to participate in our virtual Annual Meeting as they would have in an in-person meeting and will be able to listen, vote and submit questions during the virtual meeting. Stockholders may also submit questions up to 15 minutes before the start of the Annual Meeting at www.viewproxy.com/apollocref/2024/htype.asp. Questions that are pertinent to the purpose of the Annual Meeting will be answered during the meeting, subject to time constraints. We may address substantially similar questions, or questions that relate to the same topic, in a single response. Stockholders will be able to review the meeting materials at the link provided in the registration confirmation e-mail. We encourage you to submit your questions before or during the formal business portion of the meeting, in advance of the question-and-answer session, in order to ensure that there is adequate time to address questions in an orderly manner.

If you are a registered holder of shares of common stock, par value $0.01 per share (the “Common(“Common Stock”), as of the close of business on the record date, you may vote your shares of Common Stock in personby proxy or electronically at the Annual Meeting, and your Virtual Control Number will be on your Notice of Internet Availability of Proxy Materials or by proxy. your proxy card (if you received a printed copy of the proxy materials).

If you hold shares of Common Stock in “street name” through a broker or other financial institution, you must follow the instructions provided by your broker or other financial institution regarding how to instruct your broker or financial institution to vote your shares of Common Stock. If you hold your shares in “street name” through a broker or other financial institution and you wish to vote electronically at the Annual Meeting, you must provide a legal proxy from your bank or other financial institution during registration and you will be assigned a Virtual Control Number in order to vote electronically during the Annual Meeting. If you do not obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares electronically at the meeting) so long as you demonstrate proof of stock ownership when you register to attend the Annual Meeting. Instructions on how to connect and participate via the Internet, including how to register for the Annual Meeting and demonstrate proof of stock ownership, are posted at http://viewproxy.com/apollocref/2024/htype.asp. If you authorize a proxy or provide voting instructions in advance of the meeting, you do not need to register for or attend the Annual Meeting in order for your vote to be counted.

- 1 -

The Annual Meeting will begin promptly at 9:00 a.m., Eastern Time. Please check in by 8:45 a.m., Eastern Time, on the day of the Annual Meeting so that any technical difficulties may be addressed before the live webcast begins. Technicians will be ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties voting or submitting questions, you may call the technical support number that will be included in your registration confirmation email and posted on the virtual Annual Meeting login page.

Shares of Common Stock represented by properly submitted proxies received by us prior to the Annual Meeting will be voted according to the instructions specified on such proxies. Any stockholder of record submitting a proxy retains the power to revoke such proxy at any time prior to its exercise at the Annual Meeting by (i) delivering prior to the Annual Meeting a written notice of revocation to our Secretary at Apollo Commercial Real Estate Finance, Inc., 9 West 57th Street, 43rd42nd Floor, New York, New York 10019, (ii) submitting a later dated proxy or (iii) voting in personelectronically at the Annual Meeting. Attending (virtually) the Annual Meeting will not automatically revoke a stockholder’s previously submitted proxy unless such stockholder votes in person(electronically) at the Annual Meeting. If a proxy is properly authorized without specifying any voting instructions and not revoked prior to the Annual Meeting, the shares of Common Stock represented by such proxy will be votedFOR the election of the nominees named in this Proxy Statement as directors, to serve on our board of directors until our 20182025 annual meeting of stockholders and until their successors are duly elected and qualify,FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 20172024 fiscal year,FOR the resolution to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement andFOR, on an advisory basis, a frequency the approval of “1 YEAR” for future advisory votes on the compensation of our named executive officers.Apollo Commercial Real Estate Finance, Inc. 2024 Equity Incentive Plan (the “2024 Equity Incentive Plan”). As to any other business which may properly come before the Annual Meeting or any postponements or adjournments thereof, the persons named as proxy holders on your proxy card will vote the shares of Common Stock represented by properly submitted proxies atin their discretion.discretion, or, if any of the nominees named in this Proxy Statement are unable or unwilling to serve, FOR the election of any other nominees designated by our board of directors.

This Proxy Statement, the Notice of Annual Meeting of Stockholders and the related proxy card are first being made available or sent to stockholders on or about March 31, 2017.April 26, 2024.

ANNUAL REPORT

This Proxy Statement is accompanied by our Annual Report to Stockholders for the year ended December 31, 2016,2023, including financial statements audited by Deloitte & Touche LLP, our independent registered public accounting firm, and their report thereon, dated February 28, 2017.

- 1 -

VOTING SECURITIES AND RECORD DATE

Stockholders will be entitled to cast one vote for each share of Common Stock held of record at the close of business on MarchApril 15, 20172024 (the “Record Date”) with respect to (i) the election of eightnine directors to serve on our board of directors until our 20182025 annual meeting of stockholders and until their respective successors are duly elected and qualify, (ii) the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 20172024 fiscal year, (iii) the resolution to approve, on an advisory basis, the compensation of our named executive officers, (iv) the advisory proposal regardingapproval of the frequency of future stockholder advisory votes on the compensation of our named executive officers,2024 Equity Incentive Plan and (v) any other proposal for stockholder action that may properly come before the Annual Meeting or any postponements or adjournments thereof.

The presence, in person or by proxy, at the virtual Annual Meeting of holders of Common Stock entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting shall constitute a quorum. Abstentions

- 2 -

and brokernon-votes are each included in the determination of the number of sharesstockholders present at the Annual Meeting for the purpose of determining whether a quorum is present. A brokernon-vote occurs when a nominee holding shares for a beneficial owner (i.e.(e.g., a broker) does not vote on a particular proposal because such nominee does not have discretionary voting power for that particular matter and has not received instructions from the beneficial owner. Under the rules of the New York Stock Exchange (the “NYSE”), the only item to be acted upon at the Annual Meeting with respect to which a broker or nominee will be permitted to exercise voting discretion is the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 20172024 fiscal year. Therefore, if you hold your shares in street name and do not give the broker or nominee specific voting instructions on the election of directors, the resolution to approve, on an advisory basis, the compensation of our named executive officers or the advisory proposal regardingapproval of the frequency of future stockholder advisory votes on the compensation of our named executive officers,2024 Equity Incentive Plan, your shares will not be voted on those items, and a brokernon-vote will occur. Brokernon-votes will have no effect on the voting results for such items. Abstentions will have no effect on the voting results for any of the proposals.

The disposition of business scheduled to come before the Annual Meeting, assuming a quorum is present, will require the following affirmative votes: (i) for the election of a director, a plurality of all the votes cast in the election of directors at the Annual Meeting; (ii) for the ratification of the appointment of our independent registered public accounting firm, a majority of all the votes cast on the proposal; (iii) for the resolution to approve, on an advisory basis, the compensation of our named executive officers, a majority of all the votes cast on the proposal; and (iv) for the advisory proposal regardingapproval of the frequency of future advisory votes on the compensation of our named executive officers, the alternative receiving2024 Equity Incentive Plan, a majority of all the votes cast on the proposal. If no frequency receives the affirmative vote of

We have a majority vote policy for the election of directors. In an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election is required to promptly tender his or her resignation to our board of directors. Our Nominating and Corporate Governance Committee is required to promptly consider the votes cast on the proposal,resignation and make a recommendation to our board of directors intendswith respect to regard the frequency receivingtendered resignation. Our board of directors is required to take action with respect to this recommendation. Any director who tenders his or her resignation to our board of directors will not participate in the greatest number of votes as the recommendation ofcommittee’s consideration or board action regarding whether to accept such tendered resignation. The policy is included in our stockholders. Corporate Governance Guidelines and is more fully described below under “Corporate Governance—Corporate Governance Guidelines—Majority Vote Policy.”

The board of directors knows of no other matters that may properly be brought before the Annual Meeting. If other matters are properly introduced, the persons named in the proxy as the proxy holders will vote on such matters atin their discretion.

As of the Record Date, we had 91,621,274142,160,695 shares of Common Stock issued and outstanding.

- 23 -

1. ELECTION OF DIRECTORS

Board of Directors

Our board of directors is currently comprised of sevennine directors: Jeffrey M. Gault, Mark C. Biderman, Pamela G. Carlton, Brenna Haysom, Robert A. Kasdin, Eric L. Press,Katherine G. Newman, Scott S. Prince, Stuart A. Rothstein, and Michael E. Salvati.Salvati and Carmencita N.M. Whonder. As previously disclosed, in January 2024, our board of directors decreased the size of our board of directors from ten directors to nine directors in connection with the resignation of Eric L. Press as a member of our board of directors. Mr. Press’ decision to resign from our board of directors was not the result of any dispute or disagreements with our Company on any matter relating to our Company’s operations, policies or practices. In accordance with our charter (the “Charter”) and bylaws (the “Bylaws”), each director will hold office until our next annual meeting of stockholders and until his or her successor has been duly elected and qualifies, or until the director’s earlier resignation, death or removal.

Upon the recommendation of the Nominating and Corporate Governance Committee of our board of directors (the “Nominating and Corporate Governance Committee”), our board of directors is nominating seven directors forre-election and an additional director nominee for election for the first time. Jeffrey M. Gault,has nominated Mark C. Biderman, Pamela G. Carlton, Brenna Haysom, Robert A. Kasdin, Eric L. Press,Katherine G. Newman, Scott S. Prince, Stuart A. Rothstein, and Michael E. Salvati have been nominated by our board of directors to stand forre-election as directors, and Cindy Z. Michel has been nominatedCarmencita N.M. Whonder to stand for election as a director for the first time,directors, by the stockholders at the Annual Meeting, to serve until our 20182025 annual meeting of stockholders and until their respective successors are duly elected and qualify, or until their earlier resignation, death or removal. It is intended that the shares of Common Stock represented by properly submitted proxies will be voted by the persons named therein as proxy holdersFOR there-election election of Messrs. Gault, Biderman, Kasdin, Press, Prince, Rothstein and Salvati and the election of Ms. MichelMses. Carlton, Haysom, Newman and Whonder as directors, unless otherwise instructed. If the candidacy of Messrs. Gault, Biderman, Kasdin, Press, Prince, Rothstein or Salvati or Ms. MichelMses. Carlton, Haysom, Newman or Whonder should, for any reason, be withdrawn prior to the Annual Meeting, the proxies will be voted by the proxy holders in favor of such substituted candidates (if any) as shall be nominated by our board of directors. Our board of directors has no reason to believe that, if elected, any of Messrs. Gault, Biderman, Kasdin, Press, Prince, Rothstein and Salvati and Ms. MichelMses. Carlton, Haysom, Newman and Whonder will be unable or unwilling to serve as director.

Information Regarding the Nominees for Election andRe-Electionas Directors

The following information is furnished as of March 31, 2017April 26, 2024 regarding the nominees for election andre-electionas directors.

Jeffrey M. Gault.Mr. Gault, 71, has served as the Chairman of our board of directors since December 2014. Mr. Gault currently serves as the chairman of the board of Americold Logistics, LLC. Previously, Mr. Gault was president and chief executive officer of Americold Logistics from 2012 to 2014. Prior to joining Americold Logistics, during the years 2005 to 2011, Mr. Gault was President of KB Urban, a division of KB Home (NYSE: KBH), general partner of LandCap Partners, an affiliate of Whitehall Funds, and manager of an affiliate of Westbrook Partners. Prior to that, Mr. Gault served as chief operating officer of Empire Land from 2000 to 2005, general partner of the Pritzker Family affiliated partnerships from 1995 to 2000, general partner of Sun America Realty Partners, an affiliate of Sun America Incorporated from 1990 to 1995, executive vice president and director of real estate at Home Savings of America & H.F. Ahmanson & Company from 1985 to 1990, and partner at Kennard, Dalahousie and Gault from 1971 to 1985. Mr. Gault currently serves as an independent director of Great Wolf Resorts Inc. Frommid-2014 through May 2016, Mr. Gault served as anon-management director of Classic Party Rentals, a portfolio company of a fund managed by an affiliate of Apollo Global Management, LLC (NYSE:APO) (together with its subsidiaries, “Apollo”), and since June 2016, he has been a director and the interim chief executive officer of Classic Party Rentals. He was a director of Morgan’s Hotel Group Co. (NASDAQ: MHGC) from 2007 to 2011 and chairman of the Fisher Center Policy Advisory Board at the University of California at Berkeley from 2005 to 2011. Mr. Gault received a Bachelor degree in Architecture from the University of California at Berkeley and a Master of Environmental Design from Yale University. Mr. Gault was selected to serve on our board of directors because of his extensive knowledge about the real estate industry, construction finance and logistics, and his experience in a variety of executive, senior leadership and director roles.

- 3 -

Mark C. Biderman, 71,78, has been one of our directors since November 2010. Since April 2021, Mr. Biderman also served onhas been a member of the Boardboard of Directors for Apollo Residential Mortgage, Inc. (NYSE: AMTG), a Maryland corporation managed by an affiliatedirectors and chair of Apollo (“AMTG”), from its initial public offering in July 2011 until its merger withthe Audit Committee of The Liberty Company Insurance Brokers LLC, and into our company in August 2016 (the “AMTG Merger”). Sincesince February 2011,2023, Mr. Biderman hadhas been a member of the board of directors of Corse Energy Corp. Mr. Biderman served as a member of the board of directors of Atlas Energy GP LLC, General Partner of Atlas Energy, L.P., an energy-focused master limited partnership. In February of 2015, Atlas Energy GP LLC completed a merger with a subsidiary of Targa Resources Group (NYSE: TRGP), forming a new public company. Mr. Biderman then ceased being a director of Atlas Energy GP, LLC and became a director of Atlas Energy Group, LLC (NYSE: ATLS). Since August 2010, Mr. Biderman has been a member of the Board of Directors of the Full Circle Capital Corporation (NASDAQ: FULL), an externally managed business development company. In November 2016, Full Circle Capital Corporation merged with and into Great Elm Capital Corp. (NYSE: GECC). Mr. Biderman then ceased being a director of Full Circle Capital Corporation and became a director of Great Elm Capital Corp. Mr. Biderman served as a member of the Board of Directors of Atlas Energy, Inc., an independent natural gas producer that also owned an interest in an energy services provider, from July 2009 through February 2011.2015 to May 2020. Since January 2009, Mr. Biderman has been a consultant focused on the financial services sector. Mr. Biderman served as Vice Chairman of National Financial Partners Corp. (NYSE: NFP), a benefits, insurance and wealth management services firm, from September 2008 through December 2008. From November 1999 until September 2008, he served as NFP’sNational Financial Partners Corp.’s Executive Vice President and Chief Financial Officer. From 1987 to 1999, Mr. Biderman served as Managing Director and Head of the Financial Institutions Group at CIBC World Markets, or CIBC, an investment banking firm, and its predecessor, Oppenheimer & Co., Inc. Prior to investment banking, he was an equity research analyst covering the commercial banking industry. Mr. Biderman was on the “Institutional Investor” All American Research Team from 1973 to 1985 and was First Team Bank Analyst in 1974 and 1976. Mr. Biderman chaired the Due Diligence Committee at CIBC and served on the Commitment and Credit Committees. Mr. Biderman was a member of the Disciplinary Review Committee of the CFA Institute from September 2016 to August 2022. He serves on the Board of Governors and as Treasurer of Hebrew Union College-Jewish Institute of Religion, on the Board of Trustees of Congregation Rodeph Sholom, and as Chairman of the Board of Directors of Center for Jewish Life Princeton University—Hillel.Sholom. Mr. Biderman is a Chartered Financial Analyst. Mr. Biderman received a BSEB.S.E. degree, with high honors, in chemical engineering from Princeton University and an MBAM.B.A. from the Harvard Graduate School of Business Administration. Mr. Biderman qualifies as an “audit committee financial expert” under the guidelines of the Securities and Exchange Commission (the “SEC”). Mr. Biderman was selected to serve as a director on our board of directors because of his business acumen and valuable operational experience.

- 4 -

Pamela G. Carlton, 69, has been one of our directors since July 2021. Ms. Carlton is the President of Springboard Partners in Cross Cultural Leadership, LLC. After 22 years as an investment banker on Wall Street, Ms. Carlton launched Springboard in 2003, a diversity, equity and inclusion strategy and consulting firm. Prior to founding Springboard, Ms. Carlton retired as a Managing Director and Associate Director of U.S. Equity Research at JPMorgan Chase in 2003, having also served as Director of U.S. Equity Research for Chase Asset Management from 1996 to 1999. Prior to JPMorgan Chase, Ms. Carlton was an investment banker with Morgan Stanley and served as Morgan Stanley’s Co-Director of U.S. and Latin America Equity Research from 1991 to 1996. She began her career as a corporate attorney at Cleary Gottlieb Steen & Hamilton. Ms. Carlton has served on the board of directors of Evercore (NYSE: EVR) since 2019 and the board of directors of Columbia Funds (a mutual fund board of Columbia Threadneedle Investments, a subsidiary of Ameriprise Financial) since 2007, where she has served as Chair since January 2023. Ms. Carlton also has served on the board of directors of DR Bank since 2017 and the Board of Trustees of New York Presbyterian Hospital since 1996. She is a member of the Women’s Forum of New York. Ms. Carlton earned a B.A. from Williams College, graduating Magna Cum Laude, was a member of the Phi Beta Kappa Society and was elected as President of the Williams College Phi Beta Kappa Society. She also earned a J.D. from Yale Law School and an M.B.A. from Yale School of Management. Ms. Carlton was selected to serve on our board of directors because of her significant professional experience, investment banking and capital markets experience as well as her expertise in diversity, equity and inclusion matters.

Brenna Haysom, 47, has been one of our directors since February 2020. Ms. Haysom is the founder and Chief Executive Officer of Rally Labs, LLC, a consumer pharmaceutical company. Prior to founding Rally Labs in 2010, Ms. Haysom worked in the Private Equity Group at Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”), where she focused on both equity and credit investing across a range of industries that included financial services, transportation, chemicals, telecom, and media. She started her career at Lazard Ltd (formerly known as Lazard Frères & Co.) in New York where she worked in both the Mergers & Acquisitions and Restructuring groups. Ms. Haysom serves on the board of directors of H&R Real Estate Investment Trust (TSX: HR.UN), a diversified real estate investment trust (“REIT”) with office, retail, industrial and residential properties across North America for which she also serves as the chair of the Compensation, Governance and Nominating Committee and as a member of the Audit Committee. Ms. Haysom also serves on the board of directors of Venerable Holdings, Inc. and its subsidiaries Corporate Solutions Life Reinsurance Company and Venerable Insurance and Annuity Company, both insurance companies that are focused on the consolidation of variable annuity blocks. Ms. Haysom is a member of the Venerable Holdings, Inc. Audit Committee. She chairs the Venerable Insurance and Annuity Company Compensation Committee and is a member of its Nominating and Corporate Governance Committee. Ms. Haysom has an A.B. with honors in Social Studies from Harvard College, and an M.B.A. from Harvard Business School. Ms. Haysom qualifies as an “audit committee financial expert” under the guidelines of the SEC. Ms. Haysom was selected to serve on our board of directors because of her significant professional and management experience and strong background in finance.

Robert A. Kasdin, 58,66, has been one of our directors since April 2014. From July 2015 to July 2022, Mr. Kasdin has served as Senior Vice President and Chief Operating Officer of Johns Hopkins Medicine sinceand from 2018 to July 2015.2022 also as Chief Financial Officer of Johns Hopkins Medicine. Prior to joining Johns Hopkins Medicine, he served as Senior Executive Vice President of Columbia University from September 2002 to June 2015. Prior to joining Columbia University, he served as the Executive Vice President and Chief Financial Officer of the University of Michigan from 1997 to 2002. Before his service at the University of Michigan, he was the Treasurer and Chief Investment Officer for the Metropolitan Museum of Art in New York City from 1993 to 1997, and, from 1988 to 1992, served as Vice President and General Counsel for Princeton University Investment Company. He began his career as a corporate attorney at Davis Polk & Wardwell LLP. Mr. Kasdin has also served on the Boardas a director of Directors of Noranda Aluminum Holding Corporation (NYSE: NOR) an Apollo affiliate, from February 2008 to March 2014 and the Harbor Funds since January 2014. Mr. Kasdin is also2014, a trustee of the National September 11 Memorial & Museum,Barnard College since July 2023, and isas a member of the Council on Foreign Relations. From February 2008 to March 2014, Mr. Kasdin served as a member of the board of directors of Noranda Aluminum Holding Corporation (NYSE: NOR). Mr. Kasdin earned his A.B. from Princeton University and his J.D. from Harvard Law School. Mr. Kasdin was selected to serve on our board of directors based on his legal experience as well as his leadership, financial and

- 5 -

management experience with large, complex institutions, including construction projects and major real estate development on behalf of those institutions, which brings an important perspective to our strategic planning.

Cindy Z. MichelKatherine G. Newman, 43, has been nominated to stand for election as a director for the first time. Ms. Michel joined Apollo in 2007 and currently serves as Chief Compliance Officer. Prior to joining Apollo, Ms. Michel served as the Director of Compliance of the Private Equity Division and the Global Trading Strategies Group at

- 4 -

Lehman Brothers. Prior to that, she was associated with the investment bank Credit Suisse Securities as a member of its Compliance Department supporting the Private Equity and Investment Banking businesses. Before joining Credit Suisse Securities, Ms. Michel was associated with the law firm of DLA Piper LLP (US). Ms. Michel graduated from Columbia University with an A.B. in English and Economics and holds a J.D. from Boston University School of Law. Ms. Michel was nominated for election to our board of directors because of her extensive compliance experience and her strong knowledge of corporate governance and operations for public companies.

Eric L. Press, 51,45, has been one of our directors since June 2009. He2020. Ms. Newman is Partner and Senior Tax Counsel at Apollo, specializing in tax matters with respect to Apollo’s private equity funds, their investors and their investments worldwide. She also a Vice President of ACREFI Manager, LLC (our “Manager”) and a member of our Manager’s Investment Committee. Mr. Press has been a Senior Partner-Private Equity of Apollo since November 1998. Mr. Press joinedadvises the firm on its public holding structure. Prior to joining Apollo in 1998. From 1992 to 1998, Mr. Press was associated with2010, Ms. Newman practiced law at the law firm of Wachtell, Lipton, RosenAkin Gump Strauss Hauer & Katz, specializing in mergers, acquisitions, restructurings and related financing transactions. From 1987 to 1989, Mr. Press was a consultant with The Boston Consulting Group, a management consulting firm focused on corporate strategy. Mr. PressFeld LLP. Ms. Newman serves on the boardsboard of directors of Caesar’s Entertainment Corporation (NASD: CZR) (January 2008for Women’s Justice Initiative, a non-profit focused on education, access to present), Princimar Chemical Holdings, LLClegal services and affiliated entities (December 2013 to present), RCCH Health Partnersgender-based violence prevention, and affiliated entities (October 2015 to present), and Constellis Holdings, LLC and affiliated entities (August 2016 to present). Previously, he served on the boardsboard of directors of Verso Paper Corp. (NYSE: VRS) (December 2008for Chances for Children, a non-profit which provides clinical intervention services for families with young children to July 2016), Affinion Group Holdings, Inc. and its subsidiary Affinion Group Inc. (October 2005 to November 2015), Noranda Aluminum Holding Corporation (NYSE: NOR) (March 2007 to May 2015), Athene Holding Ltd. (June 2009 to February 2014), Athene Asset Management, L.P. (July 2009 to February 2014), Innkeepers USA (June 2007 to April 2010), Metals USA Holdings Corp. (November 2005 to April 2013), Quality Distribution, Inc. (NASD: QLTY) (May 2004 to May 2008), Wyndham International, Inc. (May 2005 to August 2005) and AEP Industries Inc. (NASD: AEPI) (June 2004 to February 2005). Mr. Pressstrengthen family bonds. Ms. Newman graduated magna cum laude from Harvard CollegeUniversity with an A.B. in EconomicsSocial Studies, and holds a J.D. from YaleGeorgetown University Law School, where he was a Senior Editor of the Yale Law Review. Mr. PressCenter. Ms. Newman was selected to serve on our board of directors because of his acutebased on her significant legal and tax experience in the asset management industry as well as her experience counseling business judgment and his extensive experience servingleaders across Apollo on the boards of and advising publicly traded companies.broad organizational changes.

Scott S. Prince, 53,60, has been one of our directors since November 2013. Since 2015, Mr. Prince has beenis also aCo-Founder Founding Member of GPS Investment Partners, LLC and Vicean Executive Chairman of ChironMerchant Investment Management. HeAdditionally, Mr. Prince is also currently a Partner of Maxim Capital Group, a real estate investment and lending platform where he is a Member of the Board and Chairman of the Risk Committee. In 2012, Mr. Princeco-founded Lake Success Rentals, a single family rental businesses created in partnership with Tricon Capital Group that has purchased distressed single family residences.Board. Mr. Prince was formerlythe Vice Chairman of Chiron Investment Management, LLC from 2015 until 2021 and Co-Managing Partner of Skybridge Capital from 2007 until January 2012.2011. Prior to Skybridge, Mr. Prince was a Partner at Eton Park Capital Management from its launch in 2004 until 2007, headingwhere he headed global trading and the fund’s derivatives business. Mr. Prince wasco-headCo-Head of Equities Trading and Global Equity Derivatives at Goldman Sachs and Co. through 2004, where he was named a Goldman Sachs Partner in 1998, and served on the firm’s Finance Committee and the Equity Division’s Risk Committee and Operating Committee.Committees. He was a Director of the International Securities Exchange from 2002 to 2004. He is currently an Executive Board Member of the Wharton School and isserves as a Board Member of the Hope and Heroes Pediatric Cancer Foundation and a Director of the Miami Community-Police Relations Foundation. Mr. Prince graduatedreceived a B.S. in Economics from the Wharton School of the University of Pennsylvania with a B.S. in Economics and received an MBAM.B.A. from the University of Chicago. Mr. Prince qualifies as an “audit committee financial expert” under the guidelines of the SEC. Mr. Prince was selected to serve as a director on our board of directors because of his significant finance and capital markets expertise.

Stuart A. Rothstein, 51, is58, has been our President and Chief Executive Officer and one of our directors.directors since March 2012, and also served as our interim Chief Financial Officer, Treasurer, and Secretary from January 2022 to April 2022. From September 2009 through April 1, 2013, Mr. Rothstein also served as our Chief Financial Officer, Treasurer and Secretary. He is also the Vice President of, and a member of the Investment Committee of our Manager. Since April 2023, Mr. Rothstein has been the Chief Operating Officer-Asset Backed Finance of Apollo and since 2009, Mr. Rothstein has been a partnerPartner and the Chief Operating OfficerOfficer-Real Estate of Apollo’s global real estate business.Apollo. In those roles, Mr. Rothstein is responsible for managing theday-to-day operations of the groupbusinesses as well as strategic planning development and implementation of growth and product strategies and new business development. Since its initial public offering in July 2011 through January 1, 2014, Mr. Rothstein has been a director of Apollo Realty Income Solutions, Inc., a non-traded REIT managed by Apollo (“ARIS”), since September 2021 and has served as Chairman of the Chief Financial Officer, Treasurer and SecretaryARIS board of AMTG.directors since June 2022. Since April 2022, he has been a member of the Investment Committee of ARIS Management, LLC, an affiliate of Apollo. Since February 2024, Mr. Rothstein has been Chair of the board of directors of Apollo Asset Backed Credit Company LLC. Prior to joining Apollo

- 5 -

in 2009, Mr. Rothstein was aCo-Managing Partner of Four Corners Properties, a privately held real estate investment company. Previously, he served as a Director ofwas employed by KKR Financial Advisors, LLC, overseeing all investments in commercial real estate and a Director at RBC Capital Markets, responsible for the West Coast Real Estate Investment Banking practice. Prior to RBC, Mr. Rothstein was an Executive Vice President and Chief Financial Officer of the Related Capital Company also serving as Chief Financial Officer for three publicly traded companies—Centerline Capital Corp, American Mortgage Acceptance Company and Aegis Realty Inc. Mr. Rothstein began his career at Spieker Properties, Inc., an office real estate investment trust (“REIT”) subsequently acquired by Equity Office Properties, and held various senior finance positions prior to being named Chief Financial Officer in 1999. Mr. Rothstein graduated from the Schreyer Honors College at the Pennsylvania State University with a B.S. in Accounting and received an MBAM.B.A. from the Stanford University Graduate School of Business. He is a member of Pennsylvania State University’s Smeal College of Business Real Estate Advisory Board. Mr. Rothstein was selected to serve on our board of directors because of the strategic leadership and business judgment he has demonstrated in his role as our President and Chief Executive Officer, and previously as our Chief Financial Officer, and his extensive managerial and executive experience.

- 6 -

Michael E. Salvati, 64,71, has been one of our directors since September 2009. Since December 2000, Mr. Salvati has been President at Oakridge Consulting, Inc., which provides interim management, management consulting and corporate advisory services to companies ranging in size fromstart-ups to multinational corporations. From February 2004 to May 2004, Mr. Salvati served as Chief Financial Officer of AMI Semiconductor, Inc. From September 1998 to February 2000, Mr. Salvati was Executive Vice President—Chief Operating Officer of National Financial Partners Corp. (NYSE: NFP), an Apollo affiliatedApollo-affiliated venture focusing on the consolidation of small financial services firms that service high net worth individuals. From June 1996 to June 1998, he was Chief Financial Officer of Culligan Water Technologies, Inc., an affiliate of Apollo, where he oversaw the completion of nearly 50 acquisitions over a period of 18 months. Mr. Salvati was a partner at KPMG LLP from 1990 to 1996. Mr. Salvati is a Certified Public Accountant (Inactive) and member of the American Institute of Certified Public Accountants, Illinois CPA Society. He has servedalso serves as a member of the boardboards of directors of MidCap FinCo Holdings, Limited, MidCap FinCo Intermediate Holdings, Limited, MidCap FinCo Designated Activity Company, MC Feeder, Limited, and MFIC GP, LLC (affiliates of Apollo), and he is a member of the audit committee, risk management committee and conflicts committee of MidCap FinCo Designated Activity Company. Mr. Salvati’s previous board memberships include Global Power Equipment Group, Inc. (OTC: GLPW) since August 2011, and he is currently a member of the audit committee. He also serves as a member of MidCap FinCo Holdings, Limited, and MidCap FinCo Limited (affiliates of Apollo) where he is a member of the audit committee. Mr. Salvati’s previous board memberships include, Things Remembered, Inc., Lazydays, Inc., NCH Nu World Marketing, Ltd., Coho Energy, Inc. (OTC: COHIQ), Prime Succession, Inc., and Castle Holdco 4, Ltd., an Apollo affiliate. Mr. Salvati received a B.S. in microbiology and a M.S. in accounting from the University of Illinois at Champaign-Urbana. Mr. Salvati qualifies as an “audit committee financial expert” under the guidelines of the SEC. Mr. Salvati was selected to serve as a director on our board of directors due to his strong background in public accounting and auditing.

Carmencita N.M. Whonder, 47, has been one of our directors since June 2021. Ms. Whonder serves as Policy Director at the lobbying and law firm of Brownstein Hyatt Farber Schreck, LLP (“Brownstein”). At Brownstein, Ms. Whonder provides strategic public policy advice to clients primarily in the financial services and housing sectors before the U.S. Congress and executive branch agencies. In February 2013, she founded OF WHONDER, a size inclusive luxury womenswear brand, and is the chief executive officer of Whonder Apparel Group, LLC. Prior to joining Brownstein in November 2008, Ms. Whonder served as the staff director for the Senate Subcommittee on Housing, Transportation, and Community Development and as the principal advisor on the Senate Banking, Housing and Urban Affairs Committee to United States Senator Charles E. Schumer. During the 109th Congress, from March 2004 to December 2006, she held the position of Minority Staff Director for the Senate Subcommittee on Economic Policy. From January 2001 to July 2003, Ms. Whonder has also worked as a Leadership Education Counselor for Gates Millennium Scholars Program/UNCF, an initiative of the Bill and Melinda Gates Foundation. She has been recognized as a MiSK Global Forum Delegate, a Milken Institute Young Leader, an Aspen Institute Socrates Scholar, a Council on Foreign Relations Term Member and served as a member of the Council on Foreign Relations Independent Taskforce on U.S. Trade and Investment Policy. Ms. Whonder has served as a director of MidCap Financial Investment Corporation (NASDAQ: MFIC) since July 2022. Ms. Whonder also has served as a trustee at the Population Council since 2021, and on the boards of the Brooklyn Org and DC Jazz Festival since 2022 and 2010, respectively. Ms. Whonder previously served as director of Direct ChassisLink, Inc. (March 2020 to November 2022). Ms. Whonder has a B.A. from Howard University, a diploma from the Universidad Pontificia de Salamanca and a Masters in International Public Policy from Johns Hopkins University School of Advanced International Studies. Ms. Whonder was selected to serve on our board of directors because of her significant professional experience and expertise in public policy in the financial services and housing sectors.

- 7 -

Our director nominees represent a mix of age, race, gender, tenure, skills and experience, as shown below.

Director Nominee Demographics | ||||||||||||||||||

| Biderman | Carlton | Haysom | Kasdin | Newman | Prince | Rothstein | Salvati | Whonder | ||||||||||

Years of Board Tenure(1) | 13 | 2 | 4 | 10 | 3 | 10 | 12 | 14 | 2 | |||||||||

Average Board Tenure | 7.8 | |||||||||||||||||

Gender | M | F | F | M | F | M | M | M | F | |||||||||

Race/Ethnicity | ||||||||||||||||||

African American or Black | X | X | ||||||||||||||||

White | X | X | X | X | X | X | X | |||||||||||

| (1) | Board tenure as of April 26, 2024. |

Director Nominee Skills and Experience | ||||||||||||||||||

| Biderman | Carlton | Haysom | Kasdin | Newman | Prince | Rothstein | Salvati | Whonder | ||||||||||

Public Board | X | X | X | X | X | X | X | X | ||||||||||

Investment | X | X | X | X | X | X | X | |||||||||||

REIT or Real Estate | X | X | X | X | ||||||||||||||

Business Strategy or Operations | X | X | X | X | X | X | X | X | X | |||||||||

Financial Literacy | X | X | X | X | X | X | X | X | X | |||||||||

Government or Public Policy | X | X | ||||||||||||||||

Regulatory, Legal or Compliance | X | X | X | X | ||||||||||||||

Our board of directors recommends a vote FOR the election of Messrs. Gault, Biderman, Kasdin, Press, Prince, Rothstein and Salvati and Ms. MichelMses. Carlton, Haysom, Newman and Whonder as directors.

A plurality of all of the votes cast onin the proposalelection of directors at the Annual Meeting at which a quorum is present is necessary to elect a director. Proxies solicited by our board of directors will be voted FOR Messrs. Gault, Biderman, Kasdin, Press, Prince, Rothstein and Salvati and Ms. MichelMses. Carlton, Haysom, Newman and Whonder unless otherwise instructed. Abstentions, if any, and brokernon-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

We have a majority vote policy for the election of directors. In an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election is required to promptly tender his or her resignation to our board of directors. Our Nominating and Corporate Governance Committee is required to promptly consider the resignation and make a recommendation to our board of directors with respect to the tendered resignation. Our board of directors is required to take action with respect to this recommendation. Any director who tenders his or her resignation to our board of directors will not participate in the committee’s consideration or board action regarding whether to accept such tendered resignation. The policy is included in our Corporate Governance Guidelines and is more fully described below under “Corporate Governance—Corporate Governance Guidelines—Majority Vote Policy.”

- 6 -

In accordance with our Bylaws, any vacancies occurring on our board of directors, including vacancies occurring as a result of the death, resignation, or removal of a director, or due to an increase in the size of the board of directors, may be filled only by the affirmative vote of a majority of the remaining directors in office, even if the remaining directors do not constitute a quorum, and any director elected to fill a vacancy will serve for the remainder of the full term of the directorship in which the vacancy occurred and until a successor is duly elected and qualifies, or until such director’s earlier resignation, death or removal.

There is no familial relationship among any of the members of our board of directors or executive officers. See “Corporate Governance—Director Independence.”

- 78 -

2. RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our board of directors (the “Audit Committee”) has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.2024.

Deloitte & Touche LLP has audited our financial statements since the fiscal year ended December 31, 2009 and has also provided certain tax services. Our board of directors is requesting that our stockholders ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017.2024.

Neither our Bylaws nor other governing documents or law require stockholder ratification of the Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm. However, our board of directors is submitting the appointment of Deloitte & Touche LLP to the stockholders for ratification as a matter of good corporate practice. In the event that ratification of this appointment of independent registered public accounting firm is not approved at the Annual Meeting, the Audit Committee will review its future selection of our independent registered public accounting firm. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests.

Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting via the live webcast and will be provided with an opportunity to make a statement if so desired and to respond to appropriate inquiries from stockholders.

Independent Registered Public Accounting Firm Fees

The following table summarizes the aggregate fees (including related expenses) billed to us for professional services provided by Deloitte & Touche LLP for the fiscal years ended December 31, 20162023 and 2015.2022.

| For the Fiscal Year Ended December 31, | For the Fiscal Year Ended December 31, | |||||||||||||||

| 2016 | 2015 | 2023 | 2022 | |||||||||||||

Audit Fees(1) | $ | 796,000 | $ | 734,715 | $ | 816,000 | $ | 770,000 | ||||||||

Audit-Related Fees(2) | — | — | — | — | ||||||||||||

Tax Fees(3) | 196,000 | 101,612 | 126,123 | 100,802 | ||||||||||||

All Other Fees(4) | 311,500 | 80,000 | 48,863 | 2,063 | ||||||||||||

|

|

|

| |||||||||||||

Total | $ | 1,303,500 | $ | 916,327 | $ | 990,986 | $ | 872,865 | ||||||||

|

|

|

| |||||||||||||

| (1) | 2023 and |

| (2) | There were no Audit-Related Fees incurred in |

| (3) | 2023 and |

| (4) | 2023 and |

The Audit Committee’s charter provides that the Audit Committee shall review andpre-approve the engagement fees and the terms of all auditing andnon-auditing services to be provided by theour Company’s external auditors and evaluate the effect thereof on the independence of the external auditors. All audit and tax services provided to us were reviewed andpre-approved by the Audit Committee, which concluded that the provision of such services by Deloitte & Touche LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

- 89 -

Our board of directors recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 20172024 fiscal year.

A majority of all of the votes cast on this proposal at the Annual Meeting at which a quorum is present is required for its approval. Proxies solicited by our board of directors will be voted FOR this proposal, unless otherwise instructed. Abstentions will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

- 910 -

3. ADVISORY APPROVAL OF THE COMPENSATION OF THEOUR COMPANY’S NAMED EXECUTIVE OFFICERS

As required by Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), we are providing our stockholders with the opportunity to vote to approve, on an advisory andnon-binding basis, the compensation of our named executive officers as disclosed in accordance with SEC rules in this Proxy Statement. This proposal is commonly known as a“say-on-pay” proposal. The compensation of our named executive officers as disclosed in this Proxy Statement includes the disclosure under “Executive Compensation—Compensation Discussion and Analysis,” the compensation tables and other narrative executive compensation disclosure in this Proxy Statement, as required by SEC rules.

We do not have any employees. We are managed by ACREFI Management, LLC our Manager,(our “Manager”) pursuant to the management agreement between us and our Manager dated as of September 23, 2009 (the “Management Agreement”). Under the Management Agreement, we pay our Manager the management fees described in “Certain Relationships and Related Transactions.” We do not have agreements with any of our executive officers or any employees of our Manager or its affiliates with respect to their cash compensation. Our named executive officers as described in this Proxy Statement are employees of our Manager or one of its affiliates and do not receive cash compensation from us for serving as our executive officers. Under the terms of the Management Agreement, we reimburse our Manager or its affiliates for our allocable share of the compensation, including annual base salary, bonus and any related withholding taxes and employee benefits paid to our Chief Financial Officer, currently Jai Agarwal since June 15, 2016 and previously Megan B. Gaul prior to such date,Anastasia Mironova, based on the percentage of his or her time spent managing our affairs in that role. However, we did not and do not determine the compensation payable to Mr. Agarwal or Ms. GaulMironova by our Manager.

Our Manager and personnel of our Manager and its affiliates who support our Manager in providing services to us under our Management Agreement are eligible to receive equity award compensation under the Amended and Restated Apollo Commercial Real Estate Finance, Inc. 20092019 Equity Incentive Plan (asPlan. The original effective date of such plan was September 23, 2009, and the plan has been amended and restated on February 27, 2017,and renamed effective June 12, 2019. In this Proxy Statement, we call such plan the “2009“2019 Equity Incentive Plan”).Plan.” Our named executive officers are also eligible to receive such grants. Please refer to “Executive Compensation—Compensation Discussion and Analysis” for a description of grants made under the 20092019 Equity Incentive Plan.

Accordingly, the following advisory andnon-binding resolution will be presented to our stockholders at the 20172024 Annual Meeting:

RESOLVED, that the stockholders of theour Company approve, on an advisory basis, the compensation payable to our named executive officers as disclosed in accordance with Securities and Exchange Commission rules in theour Company’s Proxy Statement for theour Company’s 20172024 Annual Meeting, including the disclosure under “Executive Compensation—Compensation Discussion and Analysis,” the compensation tables and other narrative executive compensation disclosure in the Proxy Statement relating to theour Company’s 20172024 Annual Meeting.

Although this approval is advisory andnon-binding, our board of directors and the Compensation Committee of our board of directors (the “Compensation Committee”) value the opinions of our stockholders and will consider the voting results when making future decisions regarding compensation of our named executive officers.

Our board of directors recommends a vote FOR the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in accordance with SEC rules in this Proxy Statement, including the disclosure under “Executive Compensation—Compensation Discussion and Analysis,” the compensation tables and other narrative executive compensation disclosure in this Proxy Statement.

- 1011 -

A majority of all of the votes cast on this proposal at the Annual Meeting at which a quorum is present is required for its approval. Proxies solicited by our board of directors will be voted FOR this proposal, unless otherwise instructed. Abstentions, if any, and brokernon-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

- 1112 -

4. ADVISORY PROPOSAL ON WHETHERAPPROVAL OF THE STOCKHOLDER ADVISORY VOTE ON THE COMPENSATION OF ARI’S NAMED EXECUTIVES WILL OCCUR EVERYAPOLLO COMMERCIAL REAL ESTATE FINANCE, INC. 2024 EQUITY INCENTIVE PLAN

ONE, TWO OR THREE YEARS

As required by Section 14AWe are asking stockholders to approve the 2024 Equity Incentive Plan, which would replace the 2019 Equity Incentive Plan. The 2024 Equity Incentive Plan is attached hereto as Appendix A. The 2024 Equity Incentive Plan is intended to achieve our goals of attracting, motivating, and retaining highly competent personnel through grants of equity and cash performance awards. The Compensation Committee and our board of directors have approved the 2024 Equity Incentive Plan, subject to our stockholders’ approval of the Exchange Act2024 Equity Incentive Plan at the Annual Meeting.

We strongly believe that the approval of the 2024 Equity Incentive Plan is essential to our continued success. We use equity and cash performance awards to motivate high levels of performance, to align the interests of our personnel and stockholders, and to enhance our ability to attract and retain highly qualified independent directors. We believe that the ability to grant equity and cash performance awards is important to our future success.

Comparison of the 2019 Equity Incentive Plan and 2024 Equity Incentive Plan

The following is a summary of the material differences between the 2024 Equity Incentive Plan and the 2019 Equity Incentive Plan. Please also read “2024 Equity Incentive Plan Summary” below.

The 2024 Equity Incentive Plan eliminates the 500,000 shares per grantee annual limitation.

The term of the 2024 Equity Incentive Plan will run for ten years from the earlier of the date of our board of directors’ approval or stockholder approval.

If the 2024 Equity Incentive Plan is approved, the 2019 Equity Incentive Plan will be terminated and replaced by the 2024 Equity Incentive Plan, and we will register the offers and sales of the additional approved Common Stock on a Registration Statement on Form S-8.

Share Information

The following table includes information regarding outstanding equity awards and Common Stock available for future awards under the 2019 Equity Incentive Plan as of the Record Date (and without giving effect to any approval of the 2024 Equity Incentive Plan under this proposal):

Total shares underlying outstanding, unvested restricted stock units | 2,519,337 | |||

Total shares unvested shares of restricted stock | 63,985 | |||

Total shares currently available for grant | 320,431 |

We have no outstanding awards under plans not approved by stockholders, and we have not granted stock options.

No further Common Stock will be issued pursuant to the 2019 Equity Incentive Plan between the Record Date and the approval of the 2024 Equity Incentive Plan, unless the 2024 Equity Incentive Plan is not approved. Upon approval of the 2024 Equity Incentive Plan, no further awards will be granted under the 2019 Equity Incentive Plan and shares currently available for grant will no longer be available under the 2019 Equity Incentive Plan.

- 13 -

As shown in accordancethe following table, our three-year average annual burn rate has been 0.98%.

Fiscal Year | Options Granted | Time-Based Awards Granted | Weighted Average Number of Common Shares Outstanding | Burn Rate – Total/ Weighted Common Shares Outstanding | ||||||||||||

2023 | 0 | 1,158,318 | 141,281,286 | 0.82 | % | |||||||||||

2022 | 0 | 1,590,569 | 140,534,635 | 1.13 | % | |||||||||||

2021 | 0 | 1,368,672 | 139,869,244 | 0.98 | % | |||||||||||

Background of Reasons for and the Determination of Shares Under the 2024 Equity Incentive Plan

When approving the 2024 Equity Incentive Plan, the Compensation Committee and our board of directors were primarily motivated by a desire to ensure that our Company will attract and retain officers, directors, consultants, advisers, and other personnel and increase our efforts to create long-term value for our stockholders. The Compensation Committee and our board of directors considered key factors in making their determination, including our historical grant rates, the shares remaining available for issuance under the 2019 Equity Incentive Plan, and the potential dilution associated with the Dodd-Frank Act, we2024 Equity Incentive Plan.

The recommendation to adopt the 2024 Equity Incentive Plan took into account the following key metrics, factors and philosophies:

Reasonable Plan Costs

Allows for ongoing alignment of interests through the use of equity compensation

Reasonable number of shares that may be issued: a maximum of 7,500,000 shares of Common Stock

Awards would not have a substantially dilutive effect (issuance of all awards is less than 5.1% of shares outstanding)

Estimated duration of five years

Responsible Grant Practices

Our historical three-year average burn rate is a moderate 0.98%

Minimum vesting period of one year

Stockholder-Friendly Plan Features

No single-trigger change in control vesting acceleration

No option repricing permitted without stockholder approval

No cash buyouts of options without stockholder approval

Stockholder approval required to increase the share reserve (i.e., no “evergreen” provisions)

No liberal share recycling

In light of the factors described above, the Compensation Committee and our board of directors believe the 2024 Equity Incentive Plan is reasonable and will provide a significant incentive for our officers, directors, consultants, advisers, and other personnel to increase the value of our Company for stockholders.

- 14 -

Required Vote

The approval of the 2024 Equity Incentive Plan requires the affirmative vote of a majority of the votes cast thereon at the Annual Meeting. Abstentions and broker non-votes are providingnot votes cast on the proposal and, therefore, they will have no effect on the vote.

2024 Equity Incentive Plan Summary

We summarize here the material features of the 2024 Equity Incentive Plan. We have assumed for this summary that our stockholders withwill approve the opportunity2024 Equity Incentive Plan at the Annual Meeting. We qualify this summary by reference to vote, on an advisorythe full text of the 2024 Equity Incentive Plan, which you can find in this proxy statement in Appendix A.

Purpose

The purpose of the 2024 Equity Incentive Plan is to use incentives to attract andnon-binding basis, on whether retain officers, directors, consultants, advisers, and other personnel and to encourage those individuals to increase their efforts to make our business more successful. The 2024 Equity Incentive Plan allows for grants of options, stock appreciation rights, restricted stock, RSUs (as defined below), phantom shares, dividend equivalent rights, cash-based awards, and other equity-based compensation. We consider our overall compensation philosophy when we decide to grant awards under the Company will seek an advisory vote on2024 Equity Incentive Plan.

Duration

If our stockholders approve the compensation of our named executive officers every one, two or three years. By voting on this proposal, you2024 Equity Incentive Plan, we will be able to specify how frequently stockholders would like us to hold an advisory vote ongrant awards under the compensation2024 Equity Incentive Plan until 2034, which will be the tenth anniversary from the earlier of the date of our named executive officers.

In lightboard of our stockholders’ recommendation atdirectors’ approval or stockholder approval of the 2011 annual meeting of stockholders that the advisory vote be held annually, as well as other factors,2024 Equity Incentive Plan. However, our board of directors decidedmay terminate the 2024 Equity Incentive Plan before that wetime.

Administration

The Compensation Committee will hold an annual stockholder advisory voteadminister the 2024 Equity Incentive Plan. The Compensation Committee consists of at least three individuals, each of whom is intended to be, to the extent required by Rule 16b-3 under the Exchange Act, a non-employee director. If no Compensation Committee exists, our board of directors will exercise the functions of our committee.

The Compensation Committee has broad discretion and full authority to administer and interpret the 2024 Equity Incentive Plan. In addition, the Compensation Committee’s powers include, but are not limited to, granting awards, making eligibility determinations, determining the number of shares that any award agreement covers (subject to the individual participant limitations provided in the 2024 Equity Incentive Plan), and determining the terms, provisions and conditions of each award (which may not be inconsistent with the terms of the 2024 Equity Incentive Plan). The Compensation Committee will prescribe the forms and properties of awards, take any other actions and make all other determinations that it deems necessary or appropriate in connection with the 2024 Equity Incentive Plan or its operation, administration or interpretation.

The Compensation Committee may establish performance goals that must be met in order for awards to be granted or to vest, or for the restrictions on any such awards to lapse.

Except to the extent prohibited by applicable law, rules and regulations, the Compensation Committee may allocate all or any portion of its responsibilities and powers to any one or more of its members and may delegate all or any part of its responsibilities and powers (including the power to grant awards) to any person or persons that it selects. The Compensation Committee cannot delegate its authority with respect to grants of awards to persons who are directors or who are subject to Section 16 of the Exchange Act.

- 15 -

Our board of directors may, in its sole discretion, at any time, and from time to time, grant equity awards and administer the 2024 Equity Incentive Plan with respect to any awards, subject to applicable rules. No member of our board of directors, the Compensation Committee or any employee or agent of our Company and our subsidiaries will be liable for any action taken or omitted to be taken or determination made with respect to the compensation2024 Equity Incentive Plan or any equity award granted under the 2024 Equity Incentive Plan.

Eligibility

Persons who are eligible to be granted awards under the 2024 Equity Incentive Plan are the officers, directors, advisors, personnel and employees of the Participating Companies (as defined in the 2024 Equity Incentive Plan), and other persons expected to provide significant services (of a type expressly approved by the Compensation Committee as covered services for these purposes) to one or more of the Participating Companies. Anyone who would receive an award under the 2024 Equity Incentive Plan must be someone for whom the offers and sales of our named executive officers.securities may be registered on Form S-8.

After careful consideration,Available Shares

If the proposed amendments are approved by stockholders, and subject to adjustment upon certain corporate transactions or events, a maximum of 7,500,000 shares of Common Stock may be issued (or deemed issued) under the 2024 Equity Incentive Plan. The 2024 Equity Incentive Plan provides for grants of options, stock appreciation rights, restricted stock, RSUs, dividend equivalent rights, cash-based awards and other equity-based awards.

If any shares subject to an award are forfeited or cancelled, an award expires or otherwise terminates without the issuance of shares, or an award is settled for cash or otherwise does not result in the issuance of all or a portion of the shares subject to such award, such shares will, to the extent of such forfeiture, cancellation, expiration, termination, cash settlement or non-issuance, be added to the shares available for grant under the 2024 Equity Incentive Plan on a one-for-one basis. In the event that any award is exercised through the tendering of shares or by our withholding of shares, or withholding tax liabilities arising from such award are satisfied by the tendering of shares or by our withholding of shares, then in each such case the shares so tendered or withheld shall not be added to the Common Stock available for grant under the 2024 Equity Incentive Plan on a one-for-one basis. No shares will be treated as issued in settlement of a stock appreciation right or an RSU that provides for settlement only in cash and settles only in cash.

The maximum number of shares subject to awards granted during a single fiscal year to any non-employee director under the 2024 Equity Incentive Plan, taken together with any cash fees paid to such director during the fiscal year, will not exceed $750,000 in total value in respect of any fiscal year (calculating the value of any such awards based on the grant date fair value of such awards for financial reporting purposes).

Awards Under the 2024 Equity Incentive Plan

Restricted Common Stock

A restricted stock award is an award of shares of Common Stock that are subject to restrictions on transferability and such other restrictions, if any, as the Compensation Committee may impose at the date of grant. Grants of shares of restricted Common Stock will be subject to vesting schedules and other restrictions that the Compensation Committee sets. The restrictions may lapse separately or in combination at such times, under such circumstances, including, without limitation, a specified period of employment or the satisfaction of pre-established criteria, in such installments or otherwise, as the Compensation Committee may determine.

Except to the extent restricted under an applicable award agreement, a participant granted shares of restricted Common Stock has all of the rights of a stockholder, including, without limitation, the right to vote and

- 16 -

the right to receive cash dividends on the shares of restricted Common Stock. Although we will pay dividends on shares of restricted Common Stock, whether or not vested, at the same rate and on the same date as our Common Stock (unless we provide otherwise in an award agreement), holders of shares of restricted Common Stock are prohibited from selling such shares until they vest.

Phantom Shares and RSUs

A phantom share represents a right to receive the fair market value of a share of Common Stock, or, if provided by the Compensation Committee, the right to receive the fair market value of a share of Common Stock in excess of a base value established by the Compensation Committee at the time of grant. A phantom share may also be known as a “Restricted Share Unit” or “RSU,” which is an unfunded and unsecured promise to deliver Common Stock, cash, other securities or other property, subject to certain restrictions (which may include, without limitation, a requirement that the grantee remain continuously employed or provide continuous services for a specified period of time). Our current practice is to refer to all such awards as RSUs.

RSUs will vest as provided in the applicable award agreement. Unless otherwise determined by the Compensation Committee at the time of the grant, RSUs may generally be settled in cash or by transfer of Common Stock (as provided in the grant agreement).

Dividend Equivalents

A dividend equivalent is a right to receive (or have credited) the equivalent value (in cash or Common Stock) of dividends paid on Common Stock otherwise subject to an award.

The Compensation Committee may provide that amounts payable with respect to dividend equivalents will be converted into cash or additional Common Stock. The Compensation Committee will establish all other limitations and conditions of awards of dividend equivalents as it deems appropriate.

Stock Options and Stock Appreciation Rights

The Compensation Committee will determine the terms of specific options, including whether options will constitute incentive stock options. An award agreement covering options will specify the extent to which, and period during which, an option may be exercised after termination of employment.

The exercise price of a stock option will be determined by the Compensation Committee and reflected in the applicable award agreement. The exercise price with respect to stock options may not be lower than 100% (110% in the case of an incentive stock option granted to a 10% stockholder, if permitted under the 2024 Equity Incentive Plan) of the fair market value of Common Stock on the date of grant. The aggregate fair market value (determined as of the date an option is granted) of the stock for which any option holder may be awarded incentive stock options that become exercisable for the first time during any calendar year (under the 2024 Equity Incentive Plan or any other stock option plan required to be taken into account under Section 422(d) of the Internal Revenue Code) may not exceed $100,000. Each stock option will be exercisable after the period or periods specified in the award agreement, which will generally not exceed ten years from the date of grant (or five years in the case of an incentive stock option granted to a 10% stockholder, if permitted under the 2024 Equity Incentive Plan). The Compensation Committee will determine the time or times at which an option may be exercised in whole or in part, and the method or methods by which, and the form or forms in which, payment of the option price with respect thereto may be made or deemed to have been made (including by cash, loans or third-party sale programs, or by the tender of previously-owned stock).

We may also grant stock appreciation rights, which are stock options that permit the recipient to exercise the stock option without payment of the exercise price and to receive Common Stock (or cash or a combination of the foregoing) with a fair market value equal to the excess of the fair market value of the Common Stock with respect to which the stock option is being exercised over the exercise price of the stock option with respect to that stock.

- 17 -

Options granted under the 2024 Equity Incentive Plan generally will not be transferable except by will or the laws of descent and distribution.

If an option or stock appreciation right (other than in an incentive stock option) would expire at a time when our insider trading policy (or a Company-imposed “blackout period”) prohibits trading in Common Stock, the period for exercising the option or stock appreciation right will be automatically extended until the thirtieth (30th) day following the expiration of such prohibition.

Other Share-Based Awards and Cash-Based Incentive Awards.